Understanding ‘Buy Now, Pay Later’

A financial service called “buy now, pay later” (BNPL) enables clients to make online purchases and pay for those purchases over time in a number of usually interest-free payments. With the rise of online purchasing and the advent of numerous BNPL apps and platforms, this practical payment option has gained popularity in recent years.

BNPL’s primary goal is to provide customers with an alternative to conventional credit cards by enabling them to divide their payments into smaller, easier-to-manage installments. Retailers use BNPL to increase customer traffic and lower cart abandonment rates, which helps them make more sales.

A customer normally needs to choose the BNPL service during the online checkout process as their preferred way of payment in order to use it. The consumer’s purchases are split up into a number of interest-free installments once they have been approved. The registered bank account, credit card, or debit card will thereafter periodically be used to automatically deduct these planned payments.

The fact that BNPL services often don’t require a good credit score means that a larger spectrum of customers can use them. BNPL does have several drawbacks, despite the appeal of splitting payments without accruing interest.

Consumers who wish to better manage their cash flow or buy products they cannot afford up front may find that BNPL is useful. When compared to credit cards, which may impose high interest rates for delinquent amounts, BNPL installments are a desirable option because they are interest-free.

Yet, there are some dangers associated with using BNPL services, including possible charges, overdrafts, and the desire to overspend. Customers should be aware of potential late payment costs because they might quickly mount if they miss their repayment deadlines. Customers might also discover that they have overextended their funds and wind up struggling to make their planned payments, which can have a bad effect on their credit score.

BNPL is a great choice for online buyers who require a flexible and interest-free method of payment. It does, however, have its own set of benefits and drawbacks, just like any other form of payment. When choosing BNPL services, customers should think about their individual financial status and potential dangers.

Major BNPL Providers

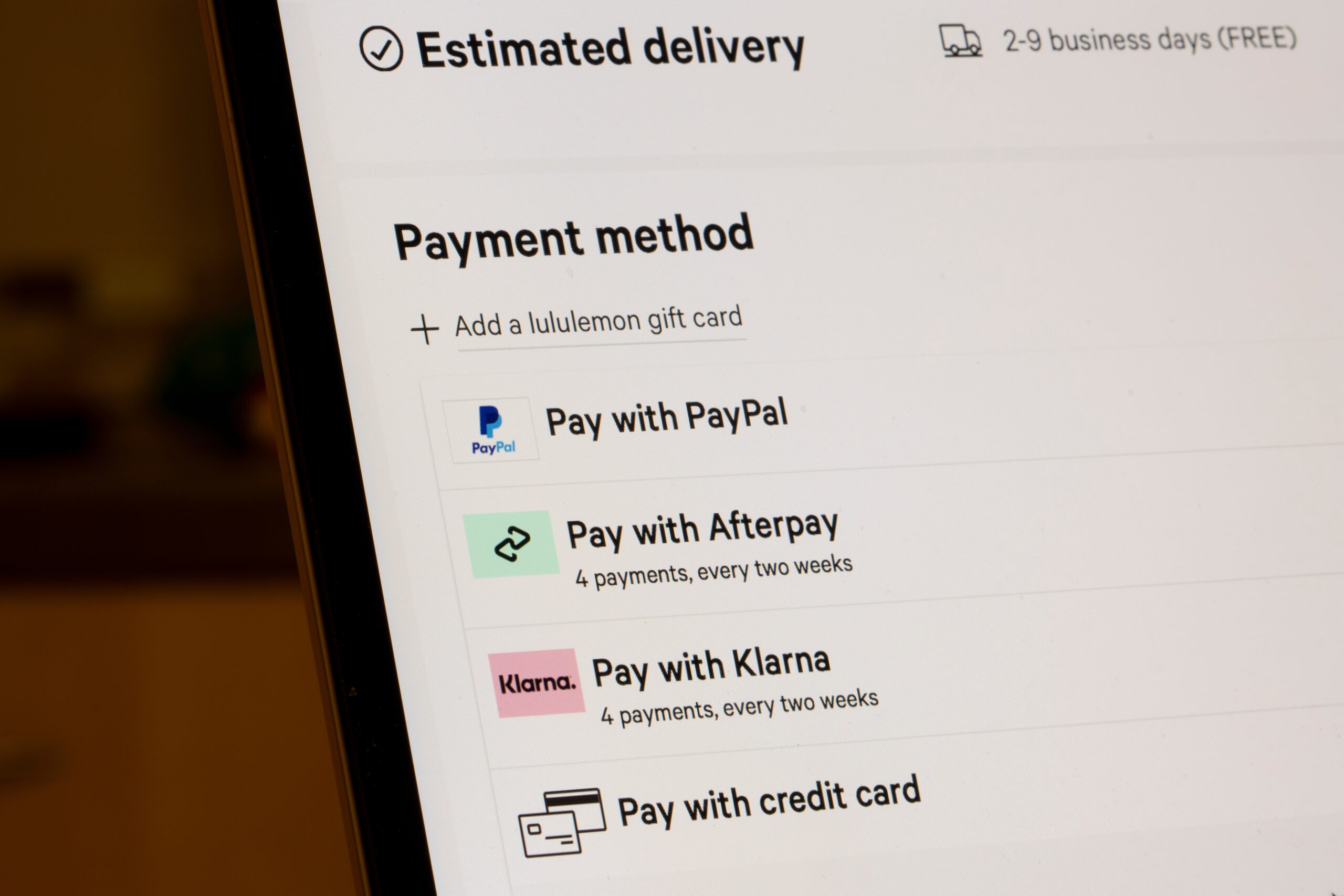

In the rapidly growing Buy Now, Pay Later (BNPL) market, several providers have emerged as key players, offering customers flexible payment options while shopping online or in-store. Affirm, Klarna, Afterpay, PayPal, and Zip are some of the most prominent BNPL providers.

Affirm is a preferred option for customers and has alliances with a variety of retailers. Customers can divide their purchases into monthly payments through Affirm, which also provides loans with durations of three to 48 months. It is renowned for its open pricing and adaptable lending terms, with some merchants providing financing alternatives with 0% APR.

Klarna is a Swedish-based provider of BNPL that has partnerships with more than 250,000 shops and operates in 17 different countries. It offers three distinct payment options: pay in four installments, pay within 30 days, or use a Klarna financing account to spread out the cost of the purchase over a longer period of time. While the other options could incur interest fees, the pay-in-4 option is interest-free.

Afterpay is an Australian fintech company that focuses on providing interest-free BNPL services for smaller ticket items. It allows users to divide their purchases into four equal payments, with the first payment due at the time of purchase and subsequent payments due every two weeks. Partnering with thousands of retailers, Afterpay offers a simple and transparent installment plan without added interest charges.

PayPal, best known for its online payment platform, has also entered the BNPL market with its “Pay in 4” service. PayPal’s plan allows customers to split their purchase into four interest-free payments over six weeks. This service is available to both new and existing PayPal users and is integrated directly into the PayPal checkout system.

Zip (formerly known as Quadpay) is another prominent BNPL provider that allows customers to pay in four interest-free installments over six weeks. With no hard credit check, Zip is accessible to a wide range of consumers and partners with retailers across various industries.

These major providers continue to compete in the BNPL market by forming partnerships with retailers, expanding their offerings, and enhancing their technological capabilities. As the BNPL space continues to evolve, consumers benefit from various financing options tailored to their budgets and shopping preferences.

Advantages of BNPL

The ease that buy now, pay later (BNPL) services provide is one of their key benefits. BNPL offers a practical solution for people who do not have the cash on hand at the moment of purchase by enabling customers to pay for their purchases over time with no interest. Customers may find it simpler to manage their finances when payment arrangements are flexible, especially when making larger purchases.

Another advantage of BNPL is that it can be utilized in place of conventional financing choices like credit cards. In contrast to credit cards, BNPL normally charges no interest if payments are made on time, which can ultimately save customers money. However, because BNPL services frequently do not report to credit agencies, using them might not have the same negative effects on a person’s credit score as using credit cards.

For those who do not have access to conventional credit choices, BNPL can act as a more inclusive financing option. Since many BNPL platforms do not conduct background checks, those with no credit history or below-average credit scores can more easily utilize these services.

It’s important to keep in mind that BNPL offers the flexibility of equal installments spread out over a predetermined period of time, whereas debit cards and cash payments require full payment upfront, which may not always be practical for larger purchases, when comparing BNPL to other payment methods like debit cards or cash.

Despite this, BNPL is not a perfect fix. While there are many advantages, there may also be disadvantages, such as the possibility of overspending or not making payments on time, which could incur late penalties or have a negative effect on one’s credit score. However, not all businesses accept BNPL as a means of payment, and some BNPL services may restrict the kinds of goods customers can buy. Yet, BNPL can offer consumers looking for an alternative to conventional financing choices a convenient and flexible payment option when utilized properly and with the right awareness of the potential hazards.

Potential Risks and Drawbacks

The risk of overpaying is one of the biggest downsides of “buy now, pay later” services. These services make it simpler for customers to buy things they might not otherwise be able to afford, which can result in more debt and strain on their finances. Consumers who are not diligent with their money management may find themselves in a loop of borrowing money and overspending it.

Programs that let you “purchase now, pay later” run the danger of increasing your fees and penalties. While some businesses don’t check your credit and provide 0% financing, other firms may impose late fees and other sanctions for missing payments. A customer may also be charged accrued interest on the total purchase price if they do not pay off their bill during the promotional time because some services feature delayed interest.

Services that allow customers to “buy now, pay later” may potentially have an effect on their credit score. While some services do report to credit agencies, not all of them do, and missing payments or past-due accounts might harm a customer’s credit history. This may make it more challenging for them to obtain loans or credit cards in the future or lead to higher borrowing interest rates.

Also, customers need to be aware of the possibility of autopay and overdraft problems. If a consumer has their “buy now, pay later” plan set up for automatic payments but does not have enough money in their account, their bank may charge overdraft fees. In some circumstances, this might lead to a cascade of charges and penalties, worsening the consumer’s financial situation.

Last but not least, “buy now, pay later” programs might promote impulsive buying. These services can attract customers to make purchases without thinking about the long-term impact on their money due to their ease and rapid gratification. This may result in a pattern of extravagant spending and debt accumulation.

Potential risks and drawbacks of “buy now, pay later” services include:

- Overspending and increased debt

- Fees, penalties, and deferred interest

- Negative impact on credit score

- Autopay and overdraft issues

- Encouragement of impulse purchasing

BNPL Impact on Credit and Personal Finance

Buy Now, Pay Later (BNPL) has grown in popularity among consumers, particularly younger generations like Millennials and members of Gen Z. Customers who choose this flexible payment option can buy a product right away and pay for it later in weekly, biweekly, or monthly payments without incurring interest. Although this kind of short-term borrowing could seem appealing, it could have both positive and bad effects on credit and personal finances.

One advantage of BNPL is that it might not demand a hard credit check, which could help people with little or no credit build credit history. However not all BNPL suppliers do, and some would only do so in the event of default, late payments, or other adverse circumstances. As a result, making payments on schedule could improve a credit score, but skipping payments could also have a negative impact.

Also, for some people, BNPL loans may encourage good financial conduct. Customers are urged to be disciplined with their payments and adhere to a budget by offering fixed payment plans and interest-free installments. These advantages can help people manage their personal finances better and keep their financial condition stable.

On the flip side of the coin, BNPL can make some people’s debt loads heavier. Customers may overspend financially as a result of making unnecessary purchases or squeezing their budgets too thin due to the accessibility and allure of these loans. Moreover, late fines or penalty costs, which are frequently connected to BNPL, may build and result in an unanticipated debt load that may be difficult to handle.

By using BNPL loans, borrowers may become less reliant on more conventional credit products like credit cards and personal loans, which frequently offer benefits and incentives that BNPL might not. The way banks and credit card firms conduct business in the future may be impacted by this trend, as they may need to modify their services and cater to the preferences of younger customers.

BNPL can affect credit and personal finances in both positive and bad ways. For some, it may aid in establishing a credit history and encouraging healthy financial habits, but for others, it may also result in increasing debt loads and excessive borrowing. In the end, it’s critical that both customers and financial institutions are aware of these possible repercussions and make wise choices while utilizing or providing BNPL products.

Understanding BNPL Fees and Interest Rates

In recent years, financing solutions that allow for buy now, pay later (BNPL) have grown in popularity. While BNPL loans give customers the option to buy things and pay for them over time, it’s important to be aware of any possible costs and interest rates.

As long as you complete your payments on time, the majority of BNPL loans do not have interest. But, if you don’t stick to the scheduled date, late payment fees could be charged. You can prevent these fines by carefully reading the terms and conditions because each BNPL lender has distinct costs and regulations. It’s important to keep a track of on-time payments because missed payments may lower your credit score.

Consider the annual percentage rate (APR), which indicates the interest rate on your loan, when comparing BNPL services. Although many BNPL providers might not impose typical APRs, some do, so it’s crucial to take this into account when choosing a lender. An overall more cheap loan is one with a lower APR.

Service charges that could be levied for utilizing BNPL are another thing to take into account. While some service providers don’t charge these costs, others could add them to your monthly installments or charge you separately. Always read the terms and conditions of the lender to make sure you are aware of any extra fees related to their BNPL service.

Making educated choices about your financing alternatives requires having a solid understanding of BNPL fees and interest rates. You can cut expenditures and make wiser financial decisions by being aware of the potential costs of utilizing BNPL.

Regulations and Consumer Protections

The “buy now, pay later” (BNPL) market has experienced tremendous expansion in recent years, with a 970% increase in BNPL loans given by five major lenders between 2019 and 2021, totaling $24.1 billion in 2021 as opposed to only $2 billion in 2019. Concerns about consumer safeguards and the requirement for regulatory control have emerged as a result of this increase.

After taking note, the Consumer Financial Protection Bureau (CFPB) recently issued a study alerting readers to the dangers and difficulties that could arise from using BNPL services. In order to ensure that proper consumer protections are in place, CFPB Director Rohit Chopra has asked for new laws to address industry abuses.

One of the main issues raised by the CFPB is the likelihood that customers will overspend while using BNPL services, as well as the potential harm that these services might do to credit ratings. Users of BNPL loans may not be sufficiently protected by current consumer protection rules, which is why the CFPB has intervened to close any potential gaps.

Consumer Reports has prepared an analysis highlighting six important areas where consumers may suffer gaps in consumer protections when making purchases with BNPL loans in response to the CFPB’s findings. These topics range from data security to dispute resolution procedures to transparency and disclosure of costs.

The CFPB is drafting guidelines and regulations specifically for this quickly expanding business in order to make sure that customers have a better awareness of the potential risks and rewards connected with BNPL services. The CFPB seeks to enhance fairness and openness in the BNPL market through the implementation of new laws, shielding customers from potential harm.

Generally, the BNPL industry’s regulatory environment is changing to keep up with its rapid expansion. To preserve a fair and open financial environment, customers and BNPL providers should both stay up to date on the most recent advances in consumer protection and laws.

BNPL during the Covid-19 Pandemic

The Covid-19 pandemic has had a big impact on the retail sector, and many companies are now using different payment methods to adapt to the change in customer behavior. Buy Now, Pay Later is one such strategy that gained popularity during the pandemic (BNPL). Since more customers look for flexible payment choices when making purchases, BNPL services have grown in popularity.

The National Retail Federation claims that the pandemic’s dramatic spike in Christmas shopping sales led to a rise in the use of BNPL services. When faced with financial uncertainty, many consumers have resorted to BNPL as a method to control their spending and yet be able to buy the things they want. The BNPL business has experienced a boom as a result, growing by $100 billion, according to CNBC.

The BNPL sector has had difficulties as a result of the epidemic, though. The effects of product delays on customers using BNPL services are a serious worry. According to Consumer Reports, due to pandemic-related delays in manufacture and delivery, some customers have found themselves paying for goods that have either been delayed or haven’t even been dispatched.

The kind of transactions people are doing while using BNPL services is another factor to take into account during the pandemic. According to Forbes, BNPL is being used for a wider range of goods and services than just standard internet shopping. This variation in BNPL usage may raise concerns about the sustainability of the sector’s expansion following the epidemic.

The Covid-19 pandemic has acted as a catalyst for the industry of “buy now, pay later,” with adoption rates rising as a result of consumer desire for flexible payment options. But, despite this expansion, the business has also had to deal with problems like the effect of product delays on customers and potential sustainability worries. Regulators and customers are currently considering the benefits and drawbacks of BNPL, as the Washington Post has noted, while its popularity during the epidemic continues to influence the retail environment.

Retailer Partners and Major Stores

In order to give customers flexible payment choices, several large retailers are collaborating with BNPL providers. Buy now, pay later (BNPL) services are growing in popularity among consumers. Target and Walmart are two well-known stores that have used BNPL services.

Several BNPL services have partnered with well-known businesses, which makes it simpler for customers to spread out their payments over time and encourages them to buy at these establishments. Retailers profit from BNPL programs’ frequently produced higher conversion rates and bigger transaction amounts. A buy-now, pay-later option can boost average ticket size by 30% to 50% and retail conversion rates by 20% to 30%, according to RBC Capital Markets.

It is important to note that not all retailers may have the same BNPL providers, and some may even have their own in-house financing options. This means that customers should always check the specific financing options available at their preferred store before making a purchase.

Some of the major BNPL providers and their retailer partners include:

- Affirm: Affirm partners with brands like Walmart, Target, Wayfair, and many others. Shoppers can find a list of participating stores on Affirm’s website.

- Klarna: Klarna is another popular BNPL provider, working with major retailers like ASOS, Sephora, and H&M, to name a few.

- Afterpay: Afterpay has a wide range of retailer partnerships, including famous brands such as Nike, Urban Outfitters, and Forever 21.

As BNPL continues to grow in popularity, more retailers are expected to incorporate these services into their checkout processes to attract and retain customers. By doing so, they are catering to the demand for convenient and flexible payment options, especially among Millennial and Gen Z consumers.

Comparing BNPL to Traditional Financing Options

An growing alternative to traditional financing, buy now, pay later (BNPL), varies from them in a number of ways. Both approaches have benefits and drawbacks. To further grasp the fundamental differences, we will compare BNPL to credit cards, personal loans, and other financing options in this section.

BNPL enables users to buy purchases and spread out their payments, just like credit cards and personal loans do. Yet, BNPL loans often provide shorter payback terms and interest-free installments. On the other hand, interest rates and APRs are frequently linked to credit cards and personal loans.

The application procedure sets BNPL apart from conventional finance choices. BNPL loans typically have a more uncomplicated application process with less emphasis on credit checks, in contrast to credit card or personal loan applications, which sometimes involve credit checks and may call for a great credit history. Those with weak or restricted credit histories may find this accessibility intriguing.

Certain BNPL service providers minimize the possibility of missed payments and credit damage by automatically deducting the installment payments from the borrower’s bank account. On the other hand, banks and credit card firms typically rely on the borrower to handle their own payments, which raises the possibility of missing payments.

The availability of rewards programs and benefits offered by credit card issuers is a benefit of utilizing regular credit cards versus BNPL loans. These incentives, which BNPL providers normally don’t provide, could include cashback possibilities and travel advantages.

The risk of overextending one’s finances is one potential drawback of BNPL loans. Borrowers who have many installment loans may find it difficult to handle them because BNPL loans have short repayment terms. Credit cards, on the other hand, give borrowers the choice of making a minimum monthly payment, giving them more flexibility in repayment.

BNPL loans differ from traditional financing options in several ways:

- Interest-free installments

- Shorter repayment periods

- Simplified application process

- Automatic deductions for installment payments

- Absence of rewards programs

While there are pros and cons to each financing method, it’s essential for borrowers to carefully consider their individual financial situation and needs before choosing the most suitable option.